Vertical Integration Doesn’t Work in Healthcare: Time to Move On

0 View

Share this Video

- Publish Date:

- 24 August, 2023

- Category:

- Mental Health

- Video License

- Standard License

- Imported From:

- Youtube

Tags

So in this week of THCB’s 20th birthday it’s a little ironic that we are running what is almost a mea culpa article from Jeff Goldsmith. I first heard Jeff speak in 1995 (I think!) at the now defunct UMGA meeting, where he explained how he felt virtual vertical integration was the best future for health care. Nearly 30 years on he has some reflections. If you want to read a longer version of this piece, it’s here—Matthew Holt

By JEFF GOLDSMITH

The concept of vertical integration has recently resurfaced in healthcare both as a solution to maturing demand for healthcare organizations’ traditional products and as a vehicle for ambitious outsiders to “disrupt” care delivery. Vertical integration is a strategy which emerged in US in the 19th industrial economy. It relied upon achieving economies of scale and co-ordination through managing the industrial value chain. We are now in a post-industrial age, where economies of scale are in scarce supply. Health enterprises that are pursuing vertical integration need to change course. If you look and feel like Sears or General Motors, you may well end up like them. This essay outlines reasons for believing that vertical integration is a strategic dead end and what actions healthcare leaders need to take.

Where Did Vertical Integration Come From?

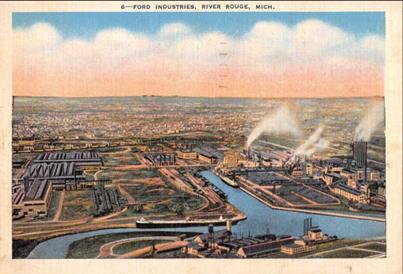

The River Rogue Ford Plant

The strategy of vertical integration was a creature of the US industrial Revolution. The concept was elucidated by the late Alfred DuPont Chandler, Jr. of the Harvard Business School. Chandler found a common pattern of growth and adaptation of 70 large US industrial firms. He looked in detail at four firms that came to dominate markedly different sectors of the US economy: DuPont, General Motors, Sears Roebuck and Standard Oil of New Jersey. They all followed a common pattern: after growing horizontally through merging with like firms, they vertically integrated by acquiring firms that supplied them raw materials or intermediate products or who distributed the finished products to final customers. Vertical integration enabled firms to own and co-ordinate the entire value chain, squeezing out middlemens’ profits.

The most famous example of vertical integration was the famed 1200 acre River Rouge complex at Ford in Detroit, where literally iron ore to make steel, copper to make wiring and sand to make windshields went in one end of the plant and finished automobiles rolled out the other end. Only the tires, made in nearby Akron Ohio, were manufactured elsewhere. Ford owned 700 thousand acres of forest, iron and limestone mines in the Mesabi range, and built a fleet of ore boats to bring the ore and other raw materials down to Detroit to be made into cars.

Subsequent stages of industrial evolution required two cycles of re-organization to achieve greater cost discipline and control, as well as diversification into related products and geographical markets. Industrial firms that did not follow this pattern either failed or were acquired. But Chandler also showed that the benefits of each stage of evolution were fleeting; specifically, the benefits conferred by controlling the entire value chain did not last unless companies took other actions. Those interested in this process should read Chandler’s pathbreaking book: Strategy and Structure: Chapters in the History of the US Industrial Enterprise (1962).

By the late 1960’s, the sun was setting on the firms Chandler wrote about. Chandler’s writing coincided with an historic transition in the US economy from a manufacturing dominated industrial economy to a post-industrial economy dominated by technology and services. Supply chains re-oriented around relocating and coordinating the value-added process where it could be most efficient and profitable. Owning the entire value chain no longer made economic sense. River Rouge was designated a SuperFund site and part of it has been repurposed as a factory for Ford’s new electric F-150 Lightning truck.

Why Vertical Integration Arose in Healthcare

I met Alfred Chandler in 1976 when I was being recruited to the Harvard Business School faculty. As a result of this meeting and reading Chandler’s writing, I wrote about the relevance to healthcare of Chandler’s framework in the Harvard Business Review in 1980 and then in a 1981 book Can Hospitals Survive: The New Competitive Healthcare Market, which was, to my knowledge, the first serious discussion of vertical integration in health services.

Can Hospitals Survive correctly predicted a significant decline in inpatient hospital use (inpatient days fell 20% in the next decade!). It also argued that Chandler’s pattern of market evolution would prevail in hospital care as the market for its core product matured. However, some of the strategic advice in this book did not age well, because it focused on defending the hospital’s inpatient franchise rather than evolving toward a more agile and less costly business model. Ambulatory services, which are today almost half of hospital revenues, were viewed as precursors to hospitalization rather than the emerging care template.

Policymakers Fell in Love with Vertical Integration: Cost Containment by HMOs

At the time of my writing, vertical integration was a hot topic in health policy. Federal policymakers’ attention was fixated on Kaiser Permanente, the largest vertically integrated actor in healthcare (then and now). Dr Paul Ellwood, a health reform advocate, persuaded the Nixon Administration to sponsor the HMO Act of 1973, designed to foster health plans modelled on Kaiser as a “pro-competitive” alternative to a government run national health insurance plan.

Nixon’s 1973 HMO Act provided federal grants to foster HMOs as a vehicle for containing soaring health spending through market mechanisms. Many multi-hospital systems-Intermountain in Utah, Henry Ford in Detroit, Sentara in Virginia, Geisinger in Pennsylvania, Humana, Lutheran Hospital Society of Southern California, Michael Reese and Rush Presbyterian Hospitals in Chicago-created their own HMOs during the 1970’s and early 80’s. As a result of these federal investments, HMOs covered 31% of the privately insured population by 1990.

However, Kaiser-style health plans did not prosper in communities with strong traditions of independent (e.g. solo and partnership) medical practice. HMOs contracting with private physicians individually or through physician sponsored Independent Practice Associations (IPAs) dominated the space. IPAs enabled physicians to participate in HMOs without being employed by them or by hospitals, and to earn extra income through shared profits.

The abortive Clinton health reforms during 1993-1995 provided a further push toward vertical integration. The almost inexplicably complex Clinton plan would have required the entire care system to be re-organized into competing Kaiser-like regional health enterprises that would receive a global payment for caring for all citizens in its region. The Clinton reforms foundered over concerns about restricting consumer choice of physicians and hospitals (and because no-one could understand exactly what they were trying to do). Nonetheless, hospitals launched a frenzy of physician practice acquisition and regional mergers to prepare for a ClintonCare which never came.

Shortly thereafter, HMOs suffered an angry consumer and employer backlash (fanned by organized medicine and hospitals). Commercial insurers including Blue Cross plans, United Healthcare, Aetna, Humana and CIGNA displaced HMOs in the commercial market using broad network Preferred Provider Organizations (PPOs) that contracted with hospitals and doctors through, mainly, discounted fee-for-service payment. Today, HMOs represent only about 12% of private insurance enrollment, of which Kaiser’s members represent well more than half.

The Obama Administration’s 2010 health reforms attempted to revive enthusiasm for vertically integrated healthcare by fostering “value based care”, a fluffy term intended to describe a raft new payment models that shifted risk onto provider organizations-hospitals, physician groups and others. The policy intent was that “value-based care” would serve as a bridge to full risk/delegated risk capitation. Thirteen years on, “value-based” care remains largely unproven as a cost containment strategy, and the evolution to full-risk capitation has not occurred.

Why Vertical Integration Hasn’t Worked in Healthcare: What the Literature Shows

We now have had five full decades of broad experimentation with vertical integration strategies in healthcare. With the benefit of hindsight, Chandler’s pattern has not worked well in this field. There has been a lot of “consolidation” but no measurable efficiency gains. Costs have soared. Something about healthcare has fiercely resisted “industrialization”.

Healthcare mergers-horizontal or vertical- have not only not reduced cost, but may actually have added cost through high transaction costs and new and expensive layers of supervision. Vertical integration of physician practice into hospitals has increased costs, not reduced them. And vertically “integrated delivery systems” that combined hospital, physicians and health plans in a single organization are neither cheaper nor of demonstrably higher quality than less integrated competitors in the same markets. As health systems diversified into non-hospital businesses, their returns on capital declined. The greater the investment, the greater the decline. (For a comprehensive review of this literature, see my 2015 piece in integrated delivery networks).

Kaiser and Geisinger

The vertical exemplar, Kaiser, has grown to $95 billion in revenues in 2022. However, it has remained largely a creature of the markets in which it originated (e.g the Pacific Coast) where over 80% of its members live. It has taken nearly eighty years to grow to 12.7 million members (and about 2% of total US health spending), despite the bursts of federal enthusiasm. Kaiser suffered several years of major financial losses by attempting to become a “national brand” in the late 1990’s. Kaiser’s success was likely attributable to the market conditions in their original markets rather than its vertical strategy.

An ominous development for the vertical strategy was the recent failure of Geisinger, a 110 year old exceptionally high quality multi-specialty physician group-based health system with a significant health plan and ten hospitals in central Pennsylvania. Geisinger lost $842 million in 2022, and was losing $20 million a month on operations when it announced a complex, non-merger style affiliation with Kaiser through a new enterprise unpromisingly named Risant. At almost $7 billion revenues, it is difficult to argue that Geisinger had insufficient scale to prosper. Rather, Geisinger’s demise as a freestanding enterprise raises serious questions about the viability of the vertically integrated model.

The Heart of the Matter: The Structure of the Value Chain in Healthcare

The main problem with the vertical integration strategy in healthcare: professional judgment and the personalized care guided by it does not scale very well. People, not raw materials, energy or capital, are the vast majority of health costs. Healthcare’s value chain is fundamentally different and more complex than that in manufacturing or retailing. There is also greater variability and uncertainty at the point of service, as well as greater personal risk to the “consumer” than just about anywhere else in the economy. Chandler’s pattern has also not held for the other professional services that dominate the American economy: education, law, accounting, consulting, etc.

Action is Needed

Vertical integration is a relic of the industrial age. It neither guarantees market dominance nor profitability in healthcare. Actors in the health system should adjust their strategies accordingly.

Keep What You Do Well or Which Would Be Missed If you Did Not Do It. Lose the Rest.

Health care enterprises’ earnings and financial positions have been damaged by the pandemic, and restoring a positive return on the organization’s assets and people is essential. Health systems that have been adjusting to this new environment with layoffs rather than examining their portfolio of businesses. It is time to ask Peter Drucker’s famous question: if we were starting fresh today, would we own all the assets and programs we have now? Do we do a good job of running them (e.g. generate both happy customers and black ink), and would anyone miss them if someone else did?

Don’t just guess what you do best. Rely on empirical sources if available, whether federal HCAHPS patient survey results or Medicare STAR ratings, Leapfrog ratings, independently gathered Net Promoter Scores or internal surveys of clinicians and managers working in each service area, as well as a searching and fearless analysis of where positive cash flow is being generated.

Community needs are an important consideration. If your community would suffer if you stopped doing something, you can count the losses you incur by continuing to do it as part of your community benefit. An important exception might be for teaching institutions, for whom the breadth of clinical experience required to train new physicians might dictate a breadth of service that does not make sense otherwise. Those losses are covered in part by Medicare’s direct and indirect medical education supplemental payments.

Services that do not sustainably return your capital or generate a positive work experience for clinicians should be flagged for divestiture, unless you need to continue doing them for teaching purposes or are meeting a significant and demonstrable unmet community need. It makes no sense to own the tenth home care agency or the sixth chain of convenience clinics just to “feed” your clinicians referrals or to field a complete “continuum of care”.

Health Plans in Hospital Systems: A Bridge to Nowhere?

The future of population-level risk in healthcare delivery enterprises is cloudy. It is true that some health systems saw windfall profits in their captive health plans from declining healthcare use during COVID provide a significant offset to their care delivery losses. But this was a once-in-a-century health emergency, not a “use case” for continuing to invest scarce capital (in a capital intensive business) in a business most care enterprises have struggled with.

Being a “payvider” is not vertical integration, nor is it an efficient vehicle for growing healthcare volumes. Health insurance and healthcare delivery are very different businesses, with dramatically different critical success factors. For care delivery entities, health insurance is unrelated and risky diversification with a high probability of negative investment returns. Unlike inside Kaiser, where the sole access point is enrollment in their health plan, there is “dysergy”, not synergy, between care delivery and health insurance. Success in the health plan business requires reducing both unit cost and utilization in care systems, as well as angering physicians, as Humana realized on its way to divesting its hospitals in the early 1990s.

Overall, health plan revenues in a few health systems (UPMC, Sentara, Spectrum/CoreWell, Geisinger, InterMountain, Aultman, Providence/Oregon) are such a significant piece of overall revenues and so significant in key local markets that the plans are integral to the future of the enterprise. How many of these systems prop up their health plans’ profitability with “below market” payment rates and pay their physician groups on an RVU basis that incents them to do “more” not “less” are interesting research questions.

For organizations with a smaller footprint in health insurance or sputtering “risk models”, it is time for an agonizing re-appraisal of these investments. Those with successful managed care infrastructure may discover that accepting delegated risk capitation, (If, and a large if indeed, it is available in their market) is a better strategy than “owning the whole premium dollar”.

Stop Relying on Market Anomalies to Justify Physician Employment

Physicians are complex professionals, not pawns on a three-dimensional chess board. Aggrandizing the market for physician care is not a cost-effective means of leveraging other healthcare businesses, be it hospitals, health insurance or pharmacies. Subsidizing physician care as a “loss leader” is not vertical integration; vertical integration was about capturing margins and leveraging economies of scale, not frantically grabbing market share.

The rush to dominate the physician marketplace has created substandard working conditions for busy professionals and conveyed the impression that physicians’ services are a means to an end, not a valuable end in itself. It also fosters the toxic illusion that those physicians’ patients belong somehow to the “owner”, not the clinicians who are responsible for them. The push by major retailers like Amazon, CVS and WalMart into the physician business is likely to end in tears, both for the companies and the professionals they employ.

Hospitals will likely lose the Medicare subsidies for employed physicians as federal budgetary conditions worsen. It is also likely the FTC will also outlaw non-compete clauses in physicians’ contracts (though non-profit hospitals and systems may be exempt). Relying on coercive measures like non-competes clauses that compel physicians to leave your community if they resign (and laying claim to their patients as if they were your property) is a sad confession of a bankrupt corporate culture. Outlawing non-competes as FTC intends will probably damage the big retail “disrupters”, the contract physician providers like Envision and Team Health and the vast enterprise that is Optum Health more than it will damage hospitals and systems.

Conclusion

Healthcare providers of all stripes must leave the industrial world behind. The value chains in health services are not physical, but rather comprised of human relationships, sustained by trust. Virtual care, the advent of AI in healthcare and consumer demand will require a flexible, 24/7 and care anywhere business model. Those who build the best modern clinical mousetrap will end up with a committed clinical staff and loyal patients. Healthcare isn’t about the building, or the brand, or scale. Surviving and thriving in the future will require engaged clinicians who foster trust on the part of their patients and the community.

Jeff Goldsmith is President of Health Futures, Inc. and a long time THCB Contributor.Jeff wants to thank the following individuals for comments on this writing: Tom Priselac, Andy Mueller, Stephen Jones, Steve Motew, Troy Wells, Kerry Shannon, Trevor Goldsmith, Nate Kaufmanand Rebecca Harrington.